Seamless Digital Client On-Boarding

Digitally Onboard Your Clients — Fast, Secure, Compliant

IT Mines offers eKYC Platform as a Service. Set up multiple onboarding journeys tailored to your business — all under your white-labeled domain.

Book a Demo

Seamless Digital Client On-Boarding

IT Mines offers eKYC Platform as a Service. Set up multiple onboarding journeys tailored to your business — all under your white-labeled domain.

Book a Demo

Customer Data Platform

IT Mines offers eKYC Platform as a Service. Set up multiple onboarding journeys tailored to your business — all under your white-labeled domain.

Effortless Client Onboarding for SEBI-Registered RIAs & RAs Digitally onboard your clients within minutes—customized to fit your business model.

Whether you prefer a tailored onboarding journey or a pre-configured flow, our solution ensures a seamless, compliant, and efficient experience from start to finish.

Define Services, Get Agreements eSigned via Aadhaar Easily outline your service deliverables and have client agreements securely eSigned using Aadhaar authentication.

Ensure faster, safer, and fully compliant documentation. You can also enable integrated eKYC to combine both onboarding and agreement signing in a single seamless digital journey.

Onboard Your HNI & Ultra-HNI Clients Seamlessly Digitally onboard your High-Net-Worth (HNI) and Ultra-HNI clients with SEBI-compliant KYC and fully customizable account opening forms. Ensure a smooth, secure, and efficient onboarding experience with digitally filled and eSigned documentation tailored to your business needs

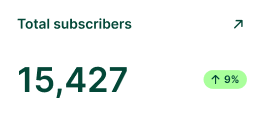

Clients Onboarded

Customer Satisfaction

Faster Conversions

Ops Time Saved

Features

Easily create multiple onboarding flows for investors, partners, or customers — no coding needed.

Your domain, your brand, your experience — provide a seamless branded onboarding interface.

Instantly verify KRA, CKYC, and document authenticity for compliant onboarding.

Seamlessly fetch Aadhaar and PAN documents in real time using secure DigiLocker APIs.

Merge KYC + agreement into one document and get it Aadhaar eSigned instantly.

Track onboarding performance, drop-off rates, KYC success, and eSign completions from one unified dashboard.

Why Choose IT Mines?

Our platform delivers lightning-fast, secure, and compliant digital journeys — all under your brand, all with zero paper

Book a DemoEnd to End secured platform with data security

Best per transaction cost model to scale up your business

On-board your clients anytime from anywhere, web or mobile as it suits you

Team has an experience of over 30 years in capital market

How It Works

Define and configure service names to match your business offerings

Choose the data points you want to capture for each service

Fully control your KYC flow—integrate Digilocker, KRA, CKYC, Penny Drop, Aadhaar eSign, counter-signing, client communications, and more

Assign Maker-Checker roles for transaction review and approval

Share your custom onboarding link (via domain or subdomain) directly on your website

Clients can browse and select the service they want to onboard for

Clients complete the onboarding journey digitally as per your defined workflow

If the journey is left incomplete, clients can return and resume anytime

The Checker reviews submitted data, KYC details, and signed documents

If any issues are found, the transaction can be rejected and the client can re-initiate the process

Once approved, the client receives a confirmation, and if counter-signing is enabled, the final signed document (by both parties) is automatically sent to the client

Monitor client status across all onboarding stages

Easily download complete KYC data and signed documents for compliance and audit purposes

Download Free eBook

Discover how India’s investment advisors are streamlining onboarding, staying compliant, and scaling with ease. Unlock our step-by-step guide, checklists, and proven digital strategies—trusted by top RIAs across India.

Digital Onboarding Checklist

Scalable Solutions for RIAs

About Us

We empower businesses to digitally verify, onboard, and sign agreements with clients, all while providing a seamless, secure, and customizable experience. Our mission is to simplify compliance without compromising on brand experience or data integrity..

Latest News

Explore insightful content that keeps you ahead of the curve to the pulse of what's happening.

As an RIA in India, you’re not just managing wealth — you’re also navigating one of the most regulated financial environments in the world. SEBI requires ...

Read More

For most Registered Investment Advisors (RIAs) in India, client onboarding still looks like a long chain of WhatsApp follow-ups, scanned PDFs, signature delays,...

Read More

As a SEBI-registered Investment Advisor (RIA), compliance is not a box you tick once — it’s an ongoing process. Between client onboarding, documentation, di...

Read More